Most high schools don’t require students to take personal finance classes, even though young people will need to manage money their entire lives.

Many students graduate without knowing how to create a budget, understand credit cards, or save for their future. This leaves them unprepared to handle the financial decisions they’ll face as adults.

The main reasons schools don’t teach personal finance include a lack of space in packed curricula, limited funding for new programs, few trained teachers, and slow-moving education systems that haven’t recognized financial literacy as a core skill.

Some people also believe that parents should teach money skills at home, which keeps financial education out of many classrooms.

Meanwhile, students face rising debt, credit card offers, and complex financial choices without proper preparation.

The gap in financial education across U.S. schools affects millions of young people each year.

Key Takeaways

- Most schools don’t teach personal finance due to crowded schedules, limited funding, and lack of trained teachers

- Students graduate without basic money skills needed to handle credit, debt, and saving decisions

- Growing awareness and advocacy are slowly pushing more states to add financial literacy requirements

The Critical Need for Personal Finance Education

Young adults face financial decisions daily, yet many lack the basic skills to manage money effectively.

Understanding budgeting, credit, and investing early can prevent costly mistakes and build long-term financial security.

Why Financial Literacy Matters

Financial literacy gives you the tools to make informed decisions about your money.

When you understand how credit works, you can avoid high-interest debt that follows you for years. When you know how to budget, you can pay your bills on time and still save for things you want.

Money management skills affect nearly every part of your life.

You need them to rent an apartment, buy a car, or apply for a loan. Without basic financial knowledge, you might sign contracts you don’t understand or fall for scams that target people who lack experience.

The benefits of financial education show up in real ways.

Students who take personal finance courses are more likely to budget, save, and avoid high-interest debt later in life. According to research, nearly 9 in 10 adults believe financial education should be required in schools.

Real-Life Impacts of Financial Illiteracy

Poor financial habits create problems that compound over time.

You might miss credit card payments because you don’t understand interest rates, damaging your credit score. A low credit score makes it harder to rent apartments, get approved for loans, or even land certain jobs.

Many adults struggle because they never learned basic financial skills in school.

They take out student loans without understanding repayment terms. They rack up credit card debt buying things they can’t afford. They don’t start saving for retirement until it’s almost too late.

The cost of financial mistakes adds up quickly.

Overdraft fees, late payment charges, and high interest rates can drain hundreds or thousands of dollars from your bank account each year.

Some people file for bankruptcy because they never learned how to manage their finances effectively.

Benefits of Early Financial Education

Learning personal finance in school prepares you for adult responsibilities before you face them alone.

You develop financial behavior patterns that last a lifetime when you start young.

Early education helps you understand the difference between needs and wants, how to set financial goals, and why saving matters.

Financial management becomes easier when you practice it early.

You learn how to track spending, create a budget, and stick to it. You understand how investing works and why starting early gives your money more time to grow.

Teaching financial literacy in schools also reduces inequality.

Students from families without financial resources get the same education as those whose parents can teach them at home. Everyone learns the same foundational skills regardless of their background.

Current State of Personal Finance in School Curricula

Personal finance education in American schools exists in a patchwork system where availability varies significantly across different regions.

Most schools still don’t offer a financial literacy course as a required part of their curriculum priorities.

Inconsistent State Requirements

Your access to personal finance education depends largely on where you live.

Each state controls its own education policy regarding financial literacy requirements. Some states mandate a standalone personal finance class for graduation, while others incorporate basic money concepts into existing math or social studies courses.

As of 2025, less than half of U.S. states require high school students to complete a dedicated personal finance curriculum before graduation.

The quality and depth of instruction varies dramatically between states that do require it. Some states offer comprehensive courses covering budgeting, investing, credit, and taxes, while others provide only minimal coverage.

This inconsistency means students in neighboring states can have completely different experiences with financial education.

A student in one state might graduate with strong money management skills, while another student just miles away receives no formal instruction at all.

Lack of National Standards

Unlike subjects such as math and science, personal finance education has no unified national standards to guide school curriculum development.

The education system has failed to identify financial skills as essential knowledge that all students should possess.

This absence of federal guidelines creates challenges for educators trying to implement consistent programs.

Teachers lack clear benchmarks for what students should learn at each grade level. Without standardized expectations, your personal finance class in one school might cover completely different topics than a course with the same name in another district.

The federal government provides limited funding or direction for financial literacy education.

States and individual school districts must determine their own curriculum priorities without comprehensive guidance on best practices or required competencies.

Elective Versus Mandatory Courses

Most schools that offer personal finance make it an elective rather than a required course.

When financial education is optional, many students graduate without ever taking it. Students often choose electives based on college admission requirements or personal interests, and financial literacy courses frequently compete with other appealing options.

Making personal finance an elective creates an equity problem.

Students whose families already discuss money management at home are more likely to recognize the value and choose the course. Students who would benefit most from formal instruction may skip it entirely.

Schools that do make personal finance mandatory see higher participation across all student demographics.

However, adding graduation requirements means adjusting existing curriculum priorities and potentially removing other courses from the schedule.

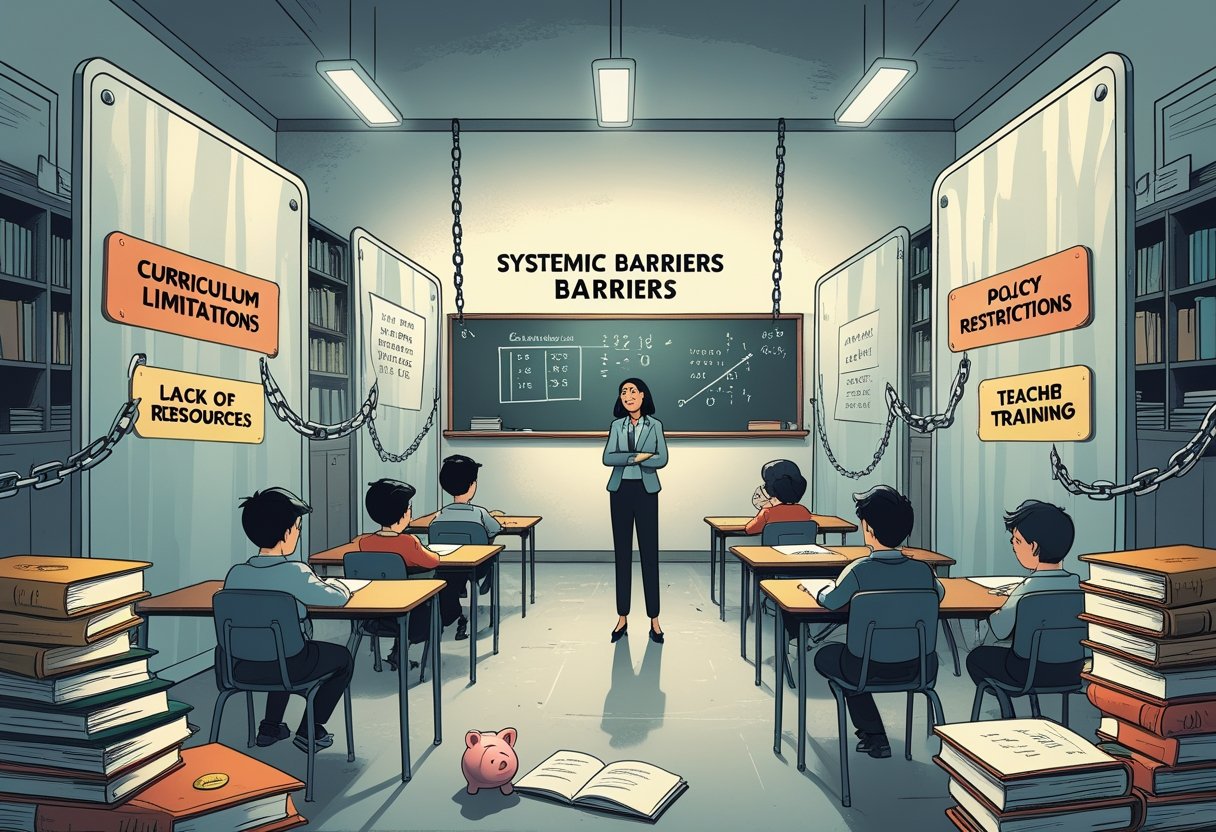

Systemic Barriers to Teaching Personal Finance

Schools face major obstacles that prevent them from adding personal finance to their programs.

These challenges include packed schedules, testing requirements, and tight budgets that make it hard to prioritize financial education.

Overcrowded Curriculum

Your child’s school day is already full with required subjects like math, science, English, and history.

Teachers must cover state standards in each subject, leaving little room for additional topics. When schools try to add financial literacy programs to the school curriculum, they often struggle to find time without removing other content.

Many states require specific courses for graduation.

These requirements push out elective classes where personal finance might fit. Schools must choose between teaching financial skills and meeting existing curriculum priorities that have been in place for decades.

The packed schedule means teachers rush through material to cover everything.

Adding another subject requires either extending the school day or cutting content from other classes. Most schools cannot make these changes easily.

Standardized Testing Priorities

Schools focus heavily on subjects that appear on standardized tests.

Your school’s funding and reputation often depend on test scores in reading, math, and science. Financial education rarely shows up on these exams.

Teachers feel pressure to spend class time on tested subjects.

This means financial education in schools takes a back seat to test preparation. Administrators worry that time spent teaching budgeting or investing could lower scores in core subjects.

Standardized testing creates a system where untested subjects get ignored.

Even when teachers want to include money management lessons, they must prioritize what gets measured. This testing focus has created a gap in practical life skills education.

Limited Funding and Resources

Your school district might lack money for new programs.

Adding personal finance classes requires textbooks, training, and materials. Many schools cannot afford these financial literacy resources while managing tight budgets.

Teacher training costs money that districts do not have.

Existing teachers need professional development to teach finance effectively. Schools must also compete with other urgent needs like building repairs and technology updates.

Budget cuts often eliminate elective programs first.

Financial literacy classes fall into this category at many schools. Without dedicated funding from state or federal sources, schools struggle to launch or maintain money management programs.

Challenges in Teacher Preparation and Resources

Teachers face major obstacles when it comes to teaching personal finance, from limited training opportunities to gaps in their own financial knowledge.

These challenges directly affect how well students learn about money management.

Insufficient Teacher Training

Most teachers don’t get enough preparation to teach personal finance. Many educators feel unprepared or underqualified to cover topics like credit, investing, budgeting, or taxes.

Traditional teacher education programs almost never include personal finance coursework. That leaves a big gap right from the start.

Without strong professional development, even the most motivated teachers can struggle. The lack of standardized training means financial education quality swings wildly from one classroom to the next.

Educator Confidence and Knowledge Gaps

Teacher confidence in teaching personal finance has gone up over the years, but it’s still not where it should be. Back in 2009, only 1 in 10 teachers felt confident teaching this subject.

By 2021, that number rose to 7 in 10, thanks to new training and resources. Still, that leaves 3 out of 10 teachers unsure about tackling these lessons.

Teachers need financial literacy knowledge for themselves and their students. Many finished school well before financial literacy was a priority, so they missed out on learning modern money concepts.

Lack of Experiential Learning Tools

Textbooks aren’t enough for teaching money skills. Teachers need hands-on tools and real-world scenarios so students can actually practice making financial decisions.

You can’t just read about budgeting; students need to try it out in a safe setting. The problem is, a lot of schools don’t have access to simulations, apps, or interactive resources that make money lessons stick.

Groups like the National Endowment for Financial Education offer free materials, but many teachers have no idea these exist. If teachers aren’t aware of these resources, students miss out on practical financial learning experiences.

Societal and Institutional Attitudes Toward Financial Education

Schools get pulled in a lot of directions when deciding if they should add personal finance to the curriculum. Some folks think families should handle money lessons at home, and others find financial topics too personal for class.

The Expectation That Parents Provide Money Lessons

There’s this idea that parents will teach their kids about money. That expectation often leads schools to skip financial education altogether.

But not all parents have strong money skills. If your parents never learned how to budget or invest, they can’t pass those skills on.

This creates a cycle—poor money management gets handed down. Some families dodge money talk because it feels awkward or private.

When financial education is missing from schools, students from these households graduate without basic knowledge about budgeting, credit, or saving.

Perceptions of Financial Topics as Taboo

Money is still a touchy subject in American culture. Most adults don’t like talking about their income, debt, or spending habits.

This discomfort seeps into schools, too. Teachers might skip financial topics to avoid awkwardness or sensitive discussions.

Talking about wealth gaps or family income differences can make everyone squirm. Schools worry that teaching money management will highlight economic divides between students.

A lesson on investing might seem pointless to kids whose families are just scraping by. These worries make administrators hesitate to require financial education courses.

Debate Over Relevance and Timing

Some educators wonder if high school students are even ready to learn about money. They argue that teens without jobs or bills can’t relate to taxes, mortgages, or retirement savings.

There’s also the question of timing—will students remember these lessons when they actually need them? A 15-year-old learning about 401(k)s might forget all about it by the time they’re 22 and starting their first job.

Still, studies look at whether financial education can shape attitudes even if behavior doesn’t change right away. Teaching these skills early at least gives students something to build on when real money decisions come up.

Opportunity Cost for Core Academic Subjects

Schools have limited time and resources. Adding a new subject means something else gets less attention.

Critics say time should go to reading, writing, math, and science instead of financial literacy. Those subjects matter more for college admissions and careers, they argue.

There’s constant pressure to boost standardized test scores in core areas. Since money management isn’t on those tests, it drops down the priority list.

The thing is, financial mistakes in adulthood can haunt you for years. Poor credit, big debt, and no savings can turn into lifelong headaches. Schools have to figure out how to prep students for both college and real life.

The Impact of Not Teaching Personal Finance

Without real financial education, students walk straight into money problems that stick with them as adults. Young adults get hit with student debt, credit card trouble, and uncertainty about the future—all because they never learned basic money skills in school.

Rising Student Debt and Financial Stress

Student loans are a huge burden for millions. Many students borrow for college without really grasping how interest works or what they’ll owe in the end.

You might sign loan papers at 18, not realizing that a $30,000 loan could balloon past $40,000 with interest. Financial stress from student debt isn’t just about money—it can delay buying a home, starting a family, or saving for retirement.

According to research, almost 9 in 10 adults think financial education should be required in schools. The mental toll of debt is real, too—anxiety, sleepless nights, and a tendency to just avoid thinking about money altogether.

Credit and Debt Management Challenges

Credit cards can be a trap if you don’t know the rules. High-interest debt gets out of hand fast if you only pay the minimum.

A $5,000 balance at 20% interest? That could take over 30 years to pay off with minimum payments. Your credit score matters for way more than loans—landlords, employers, and insurance companies all look at it.

Without credit management skills, you might:

- Miss payments and wreck your credit score

- Max out cards and lose borrowing power

- Fall into a nasty cycle of credit card debt

- Pay thousands in extra interest

Students who take personal finance courses are more likely to budget, save, and dodge high-interest debt later on.

Long-Term Effects on Financial Stability

Poor money skills can wreck your financial stability for decades. You might live paycheck to paycheck no matter how much you earn, just because you never learned to budget or save.

Unexpected expenses—like car repairs or medical bills—can push you into debt if you don’t have savings. Financial security gets harder to reach without the basics.

You might rent forever instead of building home equity. Or end up working into your 70s because you didn’t put enough away for retirement.

The lack of financial education creates real barriers that keep people from reaching their potential. Earning power doesn’t mean much if you can’t manage what you make.

Missed Opportunities for Building Wealth

Compound interest can be magic if you start investing early. If you put away $200 a month starting at 25, you could end up with over $500,000 by 65. Wait until 35, and you might only have half that.

Most people miss these chances because they never learned about them. Retirement planning sounds complicated and far-off, so it’s easy to put off.

You also lose out on:

- Employer retirement matches (seriously, that’s free money!)

- Tax-advantaged accounts like IRAs and HSAs

- Investing in low-fee index funds

- Building passive income streams

Without financial education, you might just leave all your money in a basic bank account earning pennies. Inflation eats away at your savings, and you miss out on years of growth.

Pathways Toward Improving Financial Literacy in Schools

Making financial literacy a regular part of school takes effort from a lot of places. States need better policies, teachers need more training and tools, students need hands-on practice, and communities have to fill the gaps.

Policy Changes and Advocacy

More than half of states now require some kind of financial literacy education before graduation. That’s progress, but the details are all over the map.

Some states want a full semester course, others just squeeze in a few lessons. We need consistent standards everywhere.

Advocates are pushing for laws that require a standalone financial literacy class for graduation. That way, every student learns budgeting, saving, credit, and investing before adulthood.

Schools should treat financial literacy as a core skill—right up there with math, science, and reading. That mindset shift helps secure funding and classroom time for these crucial lessons.

Investment in Teacher Training and Resources

Many schools just don’t have the time, resources, or training to teach financial literacy well. Teachers often feel unprepared when it comes to topics like taxes, loans, or retirement planning.

Without proper training, even required courses might not give students much useful knowledge. That’s a real problem, honestly.

Schools really should invest in professional development programs. Teachers need ongoing training about personal finance and teaching methods that actually work.

It helps them stay up-to-date with all the changes in financial products and the economy. No one wants to teach outdated info.

Financial literacy resources should be easy to access. Organizations like EVERFI partner with sponsors to provide interactive, online financial literacy resources at no cost to schools.

It’s a win when schools use these free tools—lesson plans, activities, assessment materials, the whole package. Why not take advantage?

Integrating Experiential and Practical Learning

Financial literacy classes work best when students actually apply what they learn. Reading about compound interest is fine, but it’s not the same as seeing how your own savings might grow.

Real-world practice builds confidence. It sticks with you.

Schools should use simulations and hands-on projects. For example, students might:

- Create and manage mock investment portfolios

- Practice filling out tax forms with sample W-2s

- Compare real loan offers and calculate total costs

- Build monthly budgets based on actual entry-level salaries

Case studies about financial decisions—good and bad—help students see real consequences. Guest speakers from banks, credit unions, or financial planning firms can share practical insights that you just won’t find in a textbook.

Community and Organizational Support

Communities need to help close education gaps. Operation HOPE focuses on economic empowerment and brings financial literacy education into schools and neighborhoods across the country.

Financial Beginnings uses trained volunteers to offer free personal finance classes nationwide. That’s a pretty big deal when you think about how many folks never get this kind of help otherwise.

Local credit unions and banks will sometimes sponsor financial literacy programs. They’ll send guest speakers, cover the cost of materials, or even host field trips.

These partnerships mean students get to hear from real financial professionals. And schools don’t have to stretch their budgets to make it happen.

Parents and families are important here, too. Schools can run evening workshops where families and students learn together.

That opens the door to money conversations at home. Kids are more likely to remember what they learn if it comes up around the dinner table, right?