Welcome — we’re so glad you’re here! We’re Jim and Keith Proctor, a father-and-son team on a mission to make personal finance simple, fun, and family-friendly. If you’re reading this, you’re probably looking to take control of your finances, and that’s a huge first step! Whether you’re just starting or feeling like your money management skills could use a little TLC, Your Personal Finance Beginner Guide is here to help you every step of the way. Personal finance can feel like a daunting and overwhelming topic, especially when numerous experts use jargon such as “assets,” “liabilities,” “compound interest,” and “credit scores.” But don’t worry—you’re not alone, and you definitely don’t need a degree in finance to understand the basics. In fact, you’ve already made the most critical decision: to learn.

This guide is designed to break down personal finance in simple, practical terms. We’ll cover everything from budgeting, saving, and investing to understanding debt and building credit, with easy-to-follow steps. Think of it like a roadmap to your financial future.

So grab a cup of coffee (or tea, we won’t judge), get comfy, and let’s dive into the world of personal finance together. It’s not about being perfect with your money; it’s about making minor, consistent improvements that will lead you to a more secure, confident financial life.

Ready? Let’s get started!

💡 What “Hacking Your Finances” Really Means

What “Hacking Your Finances” Really Means

Hey there! First off, let’s clear up the big misconception right away: when I say “hacking your finances,” I’m not talking about anything shady, illegal, or even “cheap” in a bad way. 😄 No duct-tape wallets or skipping bills here!

“Hacking” in this context just borrows the cool part of the original computer-hacking idea—finding clever, unconventional, and super-efficient ways to get better results with less effort. Applied to money, it means being smart, intentional, and a little creative so your dollars stop slipping through your fingers and start pulling their weight (and then some!).

Think of it like this: most people are on the financial “default” setting—paycheck comes in, bills go out, a little money gets spent on random stuff, repeat. Hacking your finances is switching from autopilot to manual mode, but the fun kind, where you actually end up with more money, less stress, and a lot more freedom.

Some real-life examples of what that looks like day-to-day:

- Automating your savings so the money moves into investments or high-interest accounts before you even have a chance to spend it (out of sight, out of mind = magically growing wealth).

- Hunting down and killing those sneaky “vampire fees”—bank fees, subscription creep, credit-card interest—that quietly bleed your accounts dry.

- Spending on purpose instead of on habit: asking “Does this purchase actually move me toward the life I want?” instead of “Ooh, shiny!”

- Turning everyday expenses into wins—like using the right cash-back credit card, shopping groceries with apps that pay you back, or negotiating bills everyone else just accepts.

- Making your money earn money while you sleep: moving your emergency fund from a 0.01% bank account to a high-yield savings account or safe, liquid investments that pay 4–5%+ with almost zero extra risk.

Basically, every hack we share on Let’s Hack Your Finances is something my family has personally tested and loved. We’re not financial gurus with fancy degrees—just regular people who got tired of feeling broke even when we “made good money.” So we started experimenting, kept what worked, ditched what didn’t, and now we pass the best stuff on to you.

The result? More money in your pocket, way less money stress, and the freedom to spend guilt-free on the things (and people) you truly love.

That’s the heart of hacking your finances: small, clever moves that add up to big, life-changing results—without sacrificing the fun parts of life.

Ready to try a few? Stick around; we’ve got plenty! 🚀

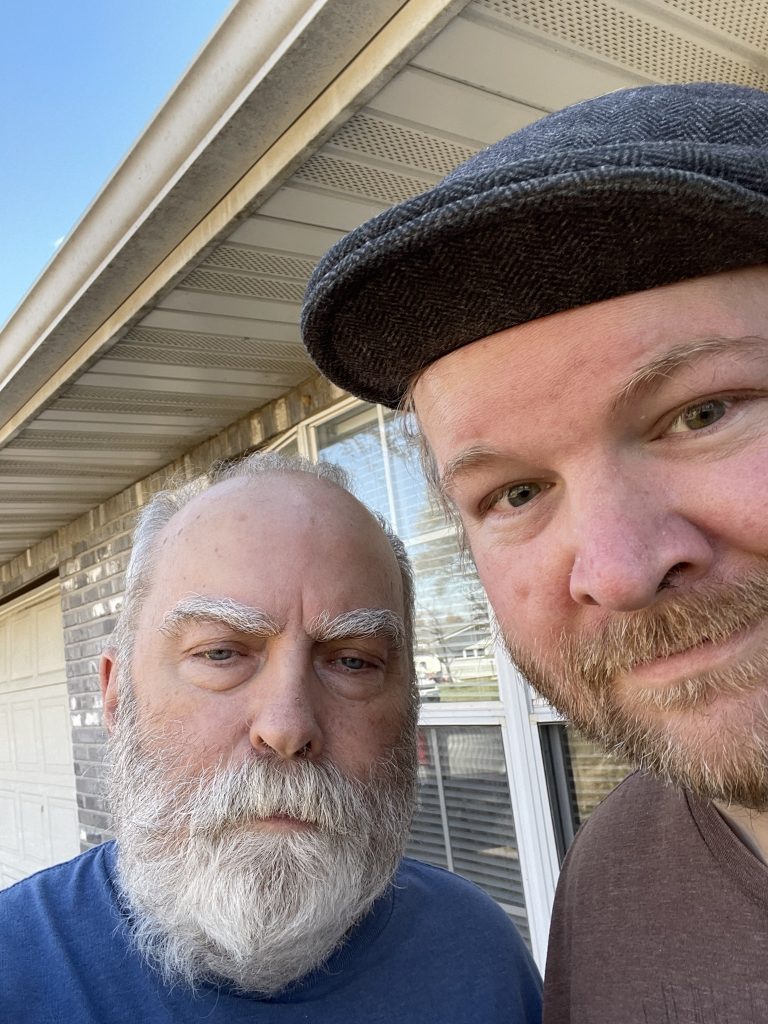

👨👦 Who We Are — Meet Jim & Keith

I’m Jim, a lifelong learner and family budget nerd. My son Keith is my partner in this journey — he’s learning the ropes of saving, spending, and investing right alongside me.

Together, we started this blog to document what works (and what doesn’t), and to show that talking about money as a family can be both empowering and fun.

💰 Step 1: Master the Basics of Personal Finance

If you’re new to personal finance, start here.

We’ll walk you through the essentials — budgeting, saving, debt, and how to set realistic financial goals.

👉 Master the Basics of Personal Finance

📊 Step 2: Build a Budget That Actually Works

We’ve tested dozens of budget styles, and we’ll show you which ones actually stick.

Learn how to build a budget that fits your lifestyle, keeps you motivated, and grows with your goals.

👉 [Read: Build a Budget That Actually Works: Practical Strategies for Financial Success

💳 Step 3: Crush Debt and Stay Out of It

Debt can feel overwhelming – but it doesn’t have to be permanent. We’ll show you step-by-step debt payoff strategies that help you take control, reduce stress, and finally move forward.

👉 [Read: Debt Payoff Strategies ]

📈 Step 4: Start Saving for the Future

Building wealth does not happen overnight – but it can happen steadily. We’ll help you start saving, even if you have only a few dollars.

👉 [Read: Start Saving for the future ]

🧠 Step 5: Teach Kids About Money

Money lessons don’t have to be boring! We share fun, hands-on ways to teach kids about saving, spending, and giving. From allowance systems to money games, we’ll show how you can build lifelong habits together.

👉 [Read: Fun ways to teach kids about money]

🧭 What’s Next? Your Roadmap to Financial Freedom

Here’s the journey we recommend:

- Learn the basics

- Create a budget

- Eliminate debt

- Build savings

- Invest for the future

Step by step, we’ll help you build your financial freedom roadmap — one hack at a time.

🚀 Ready to Start Hacking Your Finances?

Your next step is simple: pick one area to start improving today.

We’ll guide you, cheer you on, and share what’s worked for us as we learn together.